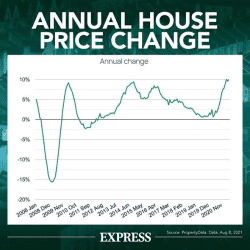

The last time that the UK was in as challenging a financial situation as it is today was in 2008 and the property crash was dominating the headlines. Caused by rising inflation and energy prices, property prices dropped by up to 18.2%, allowing cash-rich investors to snap up cheap properties, rent them out for a few years then sell them on for a healthy profit when prices increased again. Some people made enough money from flipping houses that it became a full-time job for them.

If you are thinking that the time may be right to jump into a new career as a house flipper, you should ask yourself these four questions first.

1. Do you have sufficient funds?

Whilst property prices are falling, this is, in part, because many people cannot afford to maintain their mortgage payments. This also means that fewer people can afford to take out a mortgage so there is a good chance that you will own the property for longer than may be desirable. You will need to factor in the costs of purchasing the property, renovating or modernising it, heating and maintaining it and the fees associated with selling it. If, for example, you find a Berkshire property being sold due to a dispute, it would be wise to employ a specialist firm of Ascot solicitors to handle the conveyancing for you.

2. Do you have enough time?

If you already have a full time job, are you sure that you will have the time to dedicate to investment property? Having a guaranteed income is certainly beneficial but the longer that the property is in your ownership, the more it will cost you, so having sufficient free time to dedicate to it is important. Alternatively, choosing a property that needs very little work will likely turn around faster but with smaller profit margins.

3. Are you confident in budgeting?

It is widely acknowledged that in order to make money on house flipping, you must follow the 70% rule. This means that the maximum that you should spend on purchasing a property is 70% of its after-repair value, less the costs of renovating it. If you are able to undertake building tasks yourself, you will be able to justify a higher purchase price than if you will need to hire tradespeople to carry out all required repairs and maintenance. You will need the time to carry them out to a high standard.

4. Are you familiar with the location?

You may choose to buy in your local area for your own convenience but you will often get better value for money by buying property in an up-and-coming area. Whether you are buying in Aberdeen or Ascot solicitors always recommend doing sufficient research upfront. You will need to find an area that is being developed, with good commuter links and features that are attractive to home buyers, such as green space, good schools and access to local shops.

If the answer to the above four questions is yes, then you may well be in a good position to buy.